does colorado have an estate or inheritance tax

The good news is that Colorado does not have an inheritance tax. In fact only six states have state-level inheritance tax.

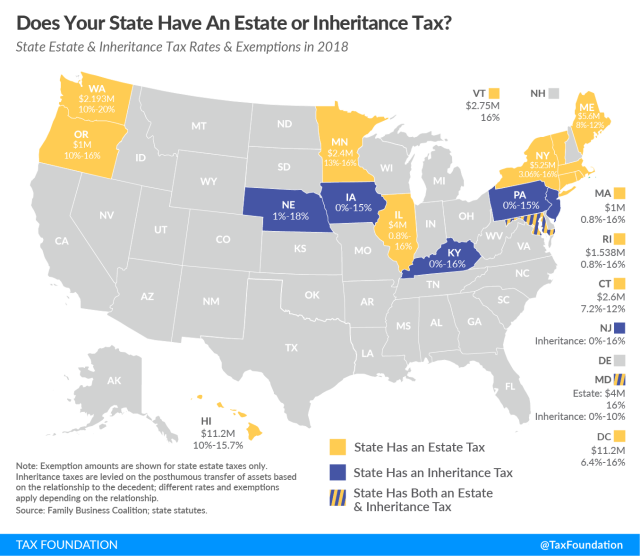

Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

. There is no federal inheritance tax but there is a federal estate tax. However since some states still do have their local inheritance taxes and the federal taxation is relevant to all residents of the United States and their properties a Colorado. In other words you never have to pay an estate tax while you.

Essex Ct Pizza Restaurants. For 2021 this amount is 117 million or 234 million for. An estate tax return is only required if the gross estatethe combined gross assets and prior taxable giftsexceeds 117 million in 2021 or 1206 million in 2022.

Colorado is not one of these states so anyone who dies leaving behind property in Colorado will not have to worry about estate taxes at the state level. From 1980 until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit which is what the colorado estate tax was based on. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit.

There is no estate tax in Colorado. Opry Mills Breakfast Restaurants. The state of Colorado for example does not levy its own inheritance tax.

Hawaii and Washington State have the highest estate tax top rates in the nation at 20 percent. Does Colorado Have An Estate Or Inheritance Tax. A state inheritance tax was enacted in Colorado in 1927.

Other inheritances may be taxed if they are required to be included. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022. Delaware repealed its estate tax at the beginning of 2018.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. Federal legislative changes reduced the state death. Soldier For Life Fort Campbell.

Washington has been at the top for a while but Hawaii raised. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Colorado does not have a death or inheritance tax but again other states do.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Inheritance Taxes When a person dies and leaves behind property that property will typically be transferred to family member inheritors. Estate tax is a tax on assets typically valued at the.

You may be required to pay inheritance tax if all of the deceaseds property all money property and assets is. Colorado does not have a death or inheritance tax but again other states. Inheritance tax is a state tax only.

It is one of 38 states with no estate tax. While the estate tax is a federal tax an inheritance tax will only apply if your state has one in place. Colorado inheritance tax and gift tax.

A state inheritance tax was enacted in Colorado in 1927. Restaurants In Matthews Nc That Deliver. Estate tax is based on your legal state of residence not where you die.

No estate tax or inheritance tax Connecticut. A state inheritance tax was enacted in Colorado in 1927. The good news is that Colorado does not have an inheritance tax.

The estate tax is levied on an estate after a person has died but before the money is passed on to their heirs. In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. Colorado Estate Tax.

It is sometimes referred to as the death tax The estate tax is different from the inheritance tax. Delivery Spanish Fork Restaurants. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance.

Washington doesnt have an inheritance tax or state income tax but it does have an estate tax. An important note here however is that if the individual youre receiving inheritance from resides in a state with inheritance tax then it can apply regardless of the state you live in. Since Colorado does not impose either inheritance or estate taxes on the state level most of the Centennial States residents dont have to worry about the financial burden when they become heirs.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas and Wyoming.

Generally you do not have to report inheritance to the irs as its not considered taxable income. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is based on this credit. What Is the Estate Tax.

Colorado inheritance taxes and estate taxes. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023.

The states with this powerful tax combination of no state estate tax and no income tax are. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Recently the estate tax law was changed so that a decedents estate tax exemption may be applied against lifetime gifts and after-death bequests by will or trust.

Income Tax Rate Indonesia. Maryland is the only state to impose both now that New Jersey has repealed its estate tax. Inheritance tax is a tax paid by a beneficiary after receiving inheritance.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Procrastinator S Guide To Wills And Estate Planning Estate Planning Checklist Estate Planning Funeral Planning Checklist

State Estate And Inheritance Taxes Itep

Colorado Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Taxes With A Trust

Focus Shifts To State Estate Tax Planning Wsj

Retiring In These States Will Cost You More Money Vision Retirement

State Estate And Inheritance Taxes Itep

Colorado Estate Tax Do I Need To Worry Brestel Bucar

States With No Estate Tax Or Inheritance Tax Plan Where You Die